Advanced taxes explained

Taxes just got a major upgrade — introducing Advanced Taxes, a feature designed to handle even the most complex tax scenarios with ease. Whether you’re charging city taxes, tourism fees, or VAT, our system now gives you the flexibility to apply taxes exactly how you need them — no more workarounds, no more compromises.

Here’s the best part: All tiers can use Advanced Taxes, with the number of taxes scaling to match your plan. Basic users can set 1 tax, Plus unlocks 3 taxes, and higher plans enjoy unlimited tax configurations.

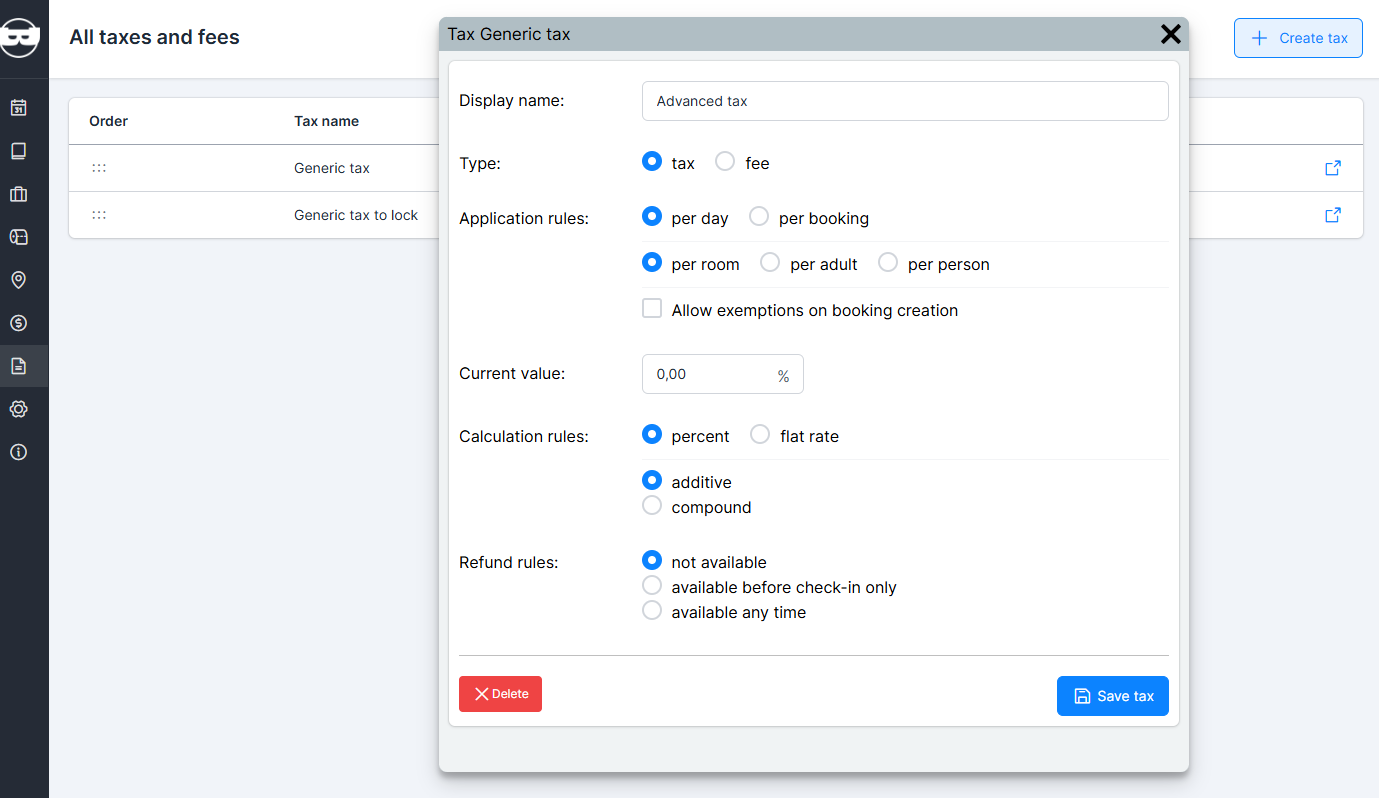

But the real magic lies in the details. You can mix and match taxes per day, per booking, per room, also per guest, or even per adult. Need a flat €2 city tax per person, per night? A 5% tourism fee on room rates? A compound VAT applied only for certain guests? Done, done, and done.

Choose between percentage or flat rate calculations, and decide whether taxes should stack additively (one after another) or compound (on top of each other). Plus, you can exclude certain taxes for specific properties — perfect for chains with varying local regulations.

And for those last-minute adjustments? Taxes can now be marked as waivable at the time of booking, giving you the freedom to accommodate special cases without jumping through hoops.

Say goodbye to rigid tax structures — Advanced Taxes put you in full control, ensuring compliance without complexity.